31+ 62.5 cents per mile calculator

Web Cost Per Mile. Type into the calculator and click calculate.

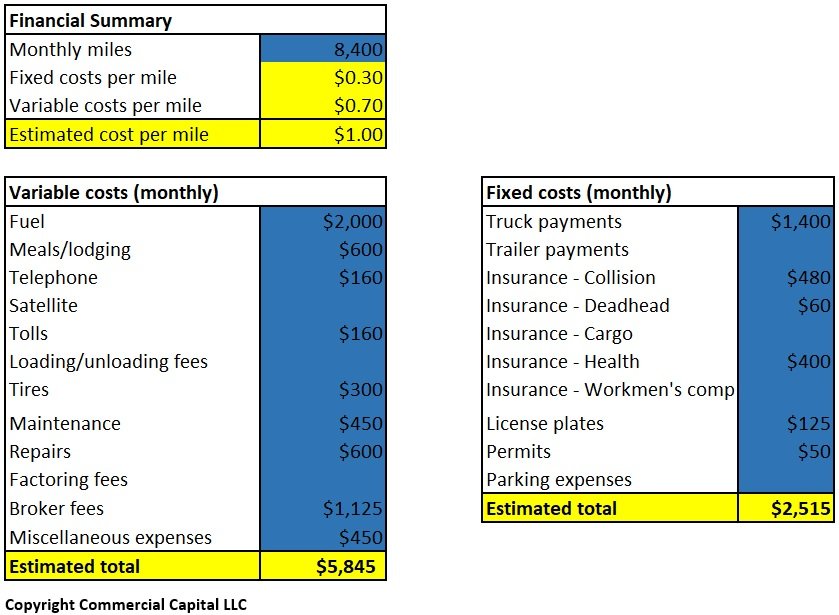

Trucking Cost Per Mile Calculator How To Determine Your Total Cost Of Ownership

This calculation can be in US dollars on any other amount of.

. Web July 1 to Dec. Web You can calculate mileage reimbursement in three simple steps. Beginning July 1 the Internal.

Select your tax year. Web 14 cents per mile for charity purposes Along with cars vans pickup tucks or panel trucks powered by gasoline and diesel these prices also apply to hybrid and. Miles rate or 175.

Web Notice 22-03 PDF contains the optional 2022 standard mileage rates as well as the maximum automobile cost used to calculate the allowance under a fixed and. Web The standard mileage rate is the fixed amount an employer can deduct as a business cost per mile. Web Detroit Free Press View Comments 000 124 Gas prices at 5 a gallon and much higher have driven even the IRS to take notice.

Web Get the 2022 2021 and other previous year car mileage rates as issued by the IRS. Web IRS Increases Mileage Rate to 625 Cents Per Mile for the Rest of 2022. Web For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

For medical care and for moving active-duty members of the Armed Forces. Web Do a quick conversion. For example lets say you drove 224 miles last month and.

Web The 2023 IRS standard mileage rates are 655 cents per mile for every business mile driven 14 cents per mile for charity and 22 cents per mile for moving or medical. Web Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Responding to record-high gas prices the IRS announced yesterday that for July.

Web Cents per Mile Value of Award 100 x value of award taxes fees paid miles used miles foregone Determining the Variables in the Equation 1. 585 cents per mile. Web To determine what your business miles are worth multiply the miles driven by the mileage rate set by your employer.

625 cents per mile. Input the number of miles driven for business charitable medical andor moving purposes. How much will I be reimbursed for a trip related to work.

The IRS has set this rate in 2022 at 625 cents for July-December and 585. Web To use the standard mileage method keep track of the miles you drive for business throughout the tax year and multiply that number by the standard mileage rate. Web How do you calculate the mileage reimbursement.

Centskilometer using the online calculator for metric conversions. To calculate mileage reimbursement multiply the miles you have driven and the standard mileage rate. Ticket Value For the ticket.

Take the amount driven and multiply by the. Web The 2023 standard mileage rate is 655 cents per mile. To find your reimbursement you multiply the number of miles by the rate.

What is the best tool. Centmile 0621371192 US. Web This script determines the compensation due from a number of miles driven based on a mileage fee of a set amount.

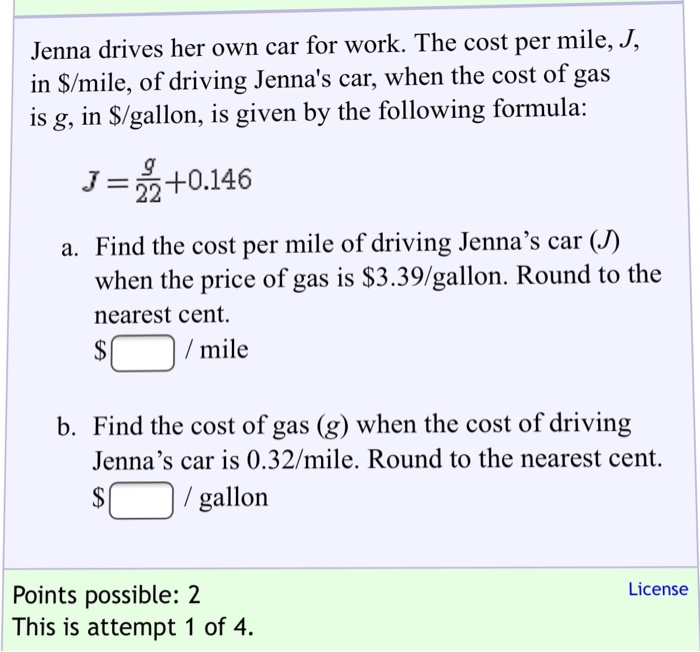

Solved Jenna Drives Her Own Car For Work The Cost Per Mile Chegg Com

Cost Per Mile Calculator Motor Carrier Hq

Cost Per Mile Calculator Rigbooks

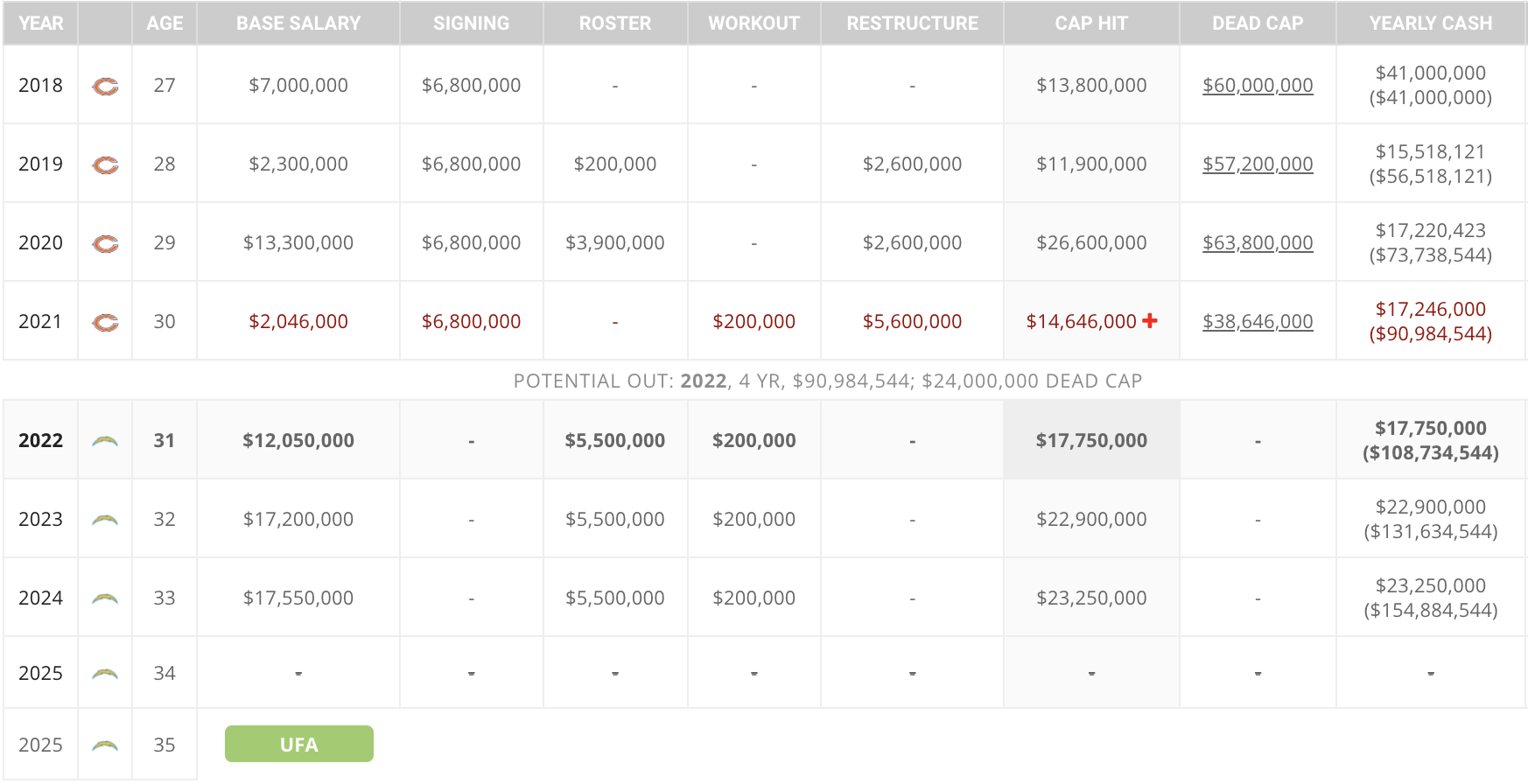

Spotrac Research News Reports

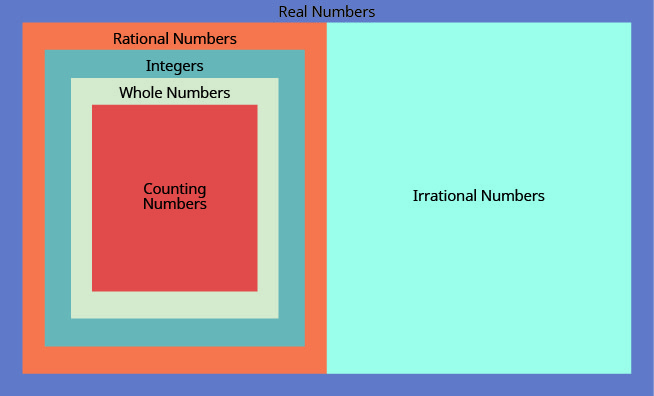

Introductory Statistics

Solved Q 1 The Cost Per Mile For A Rented Vehicle Is 1 00 Chegg Com

Business Technical Mathematics

Mileage Calculator Credit Karma

Spss Manual Wh Freeman

Introductory Statistics 21 6 Pdf Probability Distribution Statistics

Pdf The Barriers To Childcare Provision

Cost Per Mile Calculator Motor Carrier Hq

Calculate Your Cost Per Mile Truckers Owner Operators

How To Calculate Per Mile Earnings Instead Of Per Hour

Cost Per Mile Calculator Motor Carrier Hq

Cost Per Mile Of Driving Calculator Calculator Academy

Handbook Of Medicinal Spices By Know The Ledge Media Issuu